Tomorrow morning, I am heading out of town for a week-long vacation of sorts. Before I left, though, I wanted to jot down some thoughts. Some of these thoughts have been rattling around in my head for a while and some are reactions to the news of the day. Anyway, I just feel like verbalizing some of these ideas that have been echoing inside my mind. Think of this post as a sort of Reader's Digest for political news of the past few days along with some running commentary.

In what was really slightly surprising news to me, a federal court ruled a portion of the health care law unconstitutional. Specifically, the mandated purchase of insurance "exceeds the constitutional boundaries of congressional power," according to U.S. District Judge Henry E. Hudson. Of course, this is not the end of the story. The Supreme Court will ultimately decide on this issue, but it is comforting to know that there is still some respect for the Constitution in federal circles. Clearly, Nancy Pelosi has no such respect. When asked where the Constitution authorized Congress to force citizens to purchase anything, she refused to answer and acted like the questioner was crazy.

My concern is that the flaws with the health care law go far beyond the individual mandate, which looks to be the only point of serious constitutional contention. I am afraid there is really no good outcome to the legal course of action. Ultimately, the law will be implemented with or without the individual mandate. While removing the individual mandate would be a positive outcome, it does not make up for the vastly negative impact of this health care law.

The only way to really fix this law is to completely repeal it through Congress and pass a new law which is better suited to fix the problems with our health care system. Such a law is described in my previous post on the subject. Unfortunately, even if the new Congress had the votes to repeal the health care law, there is no way that Pres. Obama would allow his crown jewel to be destroyed. He would veto and Republicans simply do not have the votes to override the veto. The sad fact is we are stuck with this law until Republicans take the White House.

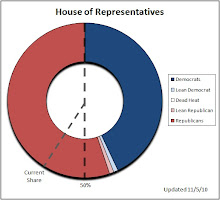

Can the Republicans take the White House in 2012? I think it is a very real possibility, with disapproval ratings above 50% and a hostile Congress that will not allow him any easy victories. Still, Republicans cannot let their guard down. The wave of momentum which gave Republicans the House in November could just as easily turn against them or, at the very least, crash down into a valley of disillusionment.

Republicans benefited from a reaction against Democratic liberalism the likes of which had never been seen in this country. They also benefited from a citizenry that was tired of failed economic policies that were driving our nation into serious debt and failing to jump start our economy in the process. Republicans now hold at least a share of the power in Washington, D.C. which means that they cannot sit idly by and let the Democrats hang themselves any longer.

Instead, Republicans must use the House as a launching point for conservative ideas. They have to present a clear alternative for the country to compare with the policies of Pres. Obama. If they do not, they risk alienating the people that gave them such an historic victory a month ago. They also risk being labeled once again as part of the problem. Do not forget that in 2008, one of the Republican's biggest problems was that conservatives had lost faith in the party, not seeing a significant difference between them and Democrats. If that remains true now, Republicans will lose every bit of the momentum they gained this year and 2012 will see a Democratic revival.

What does the ideal Republican political strategy look like, then? Well, it most certainly does not include making Hal Rogers, the "Prince of Pork," the House Appropriations Committee Chairman. Republicans absolutely cannot back down on their campaign promises of fiscal conservatism.

Republicans must not compromise that conservatism, either. Perhaps the most misinterpreted news of the last few days is the announced compromise between House Republicans and President Obama regarding the Bush tax cuts. While there are some good things in this compromise, and an extension of the Bush tax cuts at all levels of income is absolutely necessary for our economy, this compromise is a very bad thing.

First of all, we simply can't afford it. Basically, this compromise worked out something like this...

Pres. Obama - "We need to spend more to help our economy out and we need to tax more to pay for it."

Nancy Pelosi - "Yeah!"

John Boehner - "No, we need to tax less to help our economy out and need to spend less so there is less to pay for."

Pres. Obama - "Ok, you know what, we are going to quit all this political bickering and compromise. I tell you what, let's leave out the part where we pay for it and that way we can both get what we want. Let's tax less and spend more."

Nancy Pelosi - "Wait, what?"

Harry Reid - "Are you sure about that, sir?"

John Boehner - "I don't know if I can do that, Mr. President."

Pres. Obama - "I tell you what... Since I am feeling particularly generous today, I will even throw you a bone on the estate tax. Your constituents will really like that."

John Boehner - "Mr. President, you have yourself a deal."

[Boehner walks out of the room]

Nancy Pelosi - "Mr. President, I don't think I can support that deal. We need to tax the rich, that's what we have been saying for years."

Pres. Obama - "Well you don't have to support it. In fact, I'd rather you didn't. People think I'm too liberal so I need to look like I am willing to compromise for a little while. If you and your liberal friends will kick and scream long enough people will actually start to think I am on the conservative side on this."

Nancy Pelosi - "You are so smart, Mr. President. I wish I was more like you."

Harry Reid - "Me, too!"

Pres. Obama - "I love you guys!"

Ok, you get the point. This compromise is a political stunt. Pres. Obama is busy remaking his public image. Republicans are too busy championing the Bush tax cuts to see the dire consequences of what is happening. If this compromise becomes a reality, it won't necessarily be a terrible thing, but it is indicative of a larger problem. Moody's has warned numerous times now that the US will soon see its credit rating cut if it doesn't change its ways.

For too long, Republicans have championed tax cuts and Democrats have championed spending increases. Nobody has championed spending cuts. At least, not really. What we get is a series of compromises where we cut taxes and raise spending. That leads to debt, enormous piles of debt.

A credit rating cut will be disastrous for the American economy. It will only exacerbate the debt problems we have as U.S. treasuries will no longer be the world's safest investments. Foreign money which was coming here will stop and go elsewhere.

If Republicans were serious about championing the fiscal conservatism of the Tea Party movement, they cannot allow for this kind of compromise to continue. Neither can they remain the obstructionist party they were when they had no avenue for generating their own proposals. They have to actively promote alternatives, alternatives that are actually different.

The new Republican House, as soon as it arrives, should begin passing bills that have no hope of passing the Senate or the President's desk. Passing the bills into law is not the goal. The goal is to force President Obama and the Democrats in the Senate to consistently say no to conservative policy alternatives.

Republicans should consider not just extensions of Bush tax cuts, but much more extensive tax cuts that will truly spur economic growth. They should consider the Fair Tax or at least significant cuts to the income tax on the order of double what the Bush tax cuts were. Most importantly, these tax cuts must benefit all economic classes equally. Republicans cannot allow Democrats to corner them as the party of the rich again.

Republicans must also propose cuts to spending, though. Without that, they have no hope of solidifying the support of fiscal conservatives. Without it, they risk disillusionment and a return of the belief that Republicans are just political opportunists who are not willing to take the necessary measures to fix the real problem, and that is a federal government too big to support.

Republicans must not just aim to repeal the health care law. They must propose an alternative that looks significantly different.

This is the key. Republicans cannot simply say no any longer. They must propose new ideas, new solutions which can serve as the platform for a Presidential bid in 2012. Without remaining proactive, Republicans will lose their momentum and any chance they have to overtake President Obama in the next elections.

After all, President Obama is "itching for a fight." Republicans should give him one. In particular, I am looking forward to the first budget battle between the new House and Pres. Obama. That, I believe, will tell the tale on the new Republicans. Are they really serious about being fiscally conservative? We will find out then .